Embarking on the journey of selecting a Shopify Capital Loan for your Ecommerce Growth requires careful consideration and insight. This guide delves into key factors, loan types, application processes, and strategies to maximize growth, providing a roadmap for success in the realm of ecommerce financing.

Factors to Consider When Choosing a Shopify Capital Loan

When deciding on a Shopify Capital Loan for your ecommerce growth, it is crucial to assess your business needs carefully. Understanding your financial requirements and goals will help you choose the right loan amount and terms that align with your business objectives.

Importance of Assessing Your Business Needs

Before selecting a Shopify Capital Loan, it is essential to evaluate your business needs to determine the purpose of the loan. Whether you need funds for inventory, marketing, expansion, or other operational expenses, a clear understanding of your requirements will guide you in choosing the most suitable loan option.

Key Financial Metrics to Evaluate

When deciding on the loan amount, consider key financial metrics such as your revenue projections, cash flow, and profitability. Analyzing these metrics will help you determine the amount of capital required to support your ecommerce growth initiatives and ensure that you can comfortably repay the loan without straining your finances.

Role of Interest Rates

Interest rates play a crucial role in determining the overall cost of the loan. Compare interest rates offered by different lenders to find a competitive rate that minimizes the total interest expenses over the loan term. Lower interest rates can significantly reduce the cost of borrowing and improve your profitability in the long run.

Understanding Different Types of Shopify Capital Loans

When it comes to Shopify capital loans, there are several types available to help businesses with their growth and financial needs. Understanding the differences between these loan options is crucial for making the right choice for your ecommerce business.

Short-term vs. Long-term Loans

Short-term loans and long-term loans are two common options for businesses seeking capital. Here is a comparison of the benefits and drawbacks of each:

- Short-term Loans:

- Benefits:

- Quick access to funds for immediate needs.

- Flexible repayment terms.

- Usually easier to qualify for.

- Drawbacks:

- Higher interest rates compared to long-term loans.

- Short repayment period, which can put strain on cash flow.

- Benefits:

- Long-term Loans:

- Benefits:

- Lower interest rates.

- Extended repayment periods for manageable monthly payments.

- Can be used for larger investments and expansion.

- Drawbacks:

- Longer application process and stricter eligibility criteria.

- May require collateral to secure the loan.

- Benefits:

Significance of Collateral Requirements

Collateral is an important factor when it comes to securing a loan, as it provides a guarantee to the lender in case the borrower defaults on the loan. Here is the significance of collateral requirements for different types of loans:

- Secured Loans:

- Require collateral, such as inventory, equipment, or real estate, to secure the loan.

- Lower interest rates compared to unsecured loans due to reduced risk for the lender.

- If the borrower fails to repay the loan, the lender can seize the collateral to recoup their losses.

- Unsecured Loans:

- Do not require collateral, but typically have higher interest rates.

- May have stricter eligibility criteria to compensate for the lack of collateral.

- Borrowers with strong credit history and financial standing are more likely to qualify for unsecured loans.

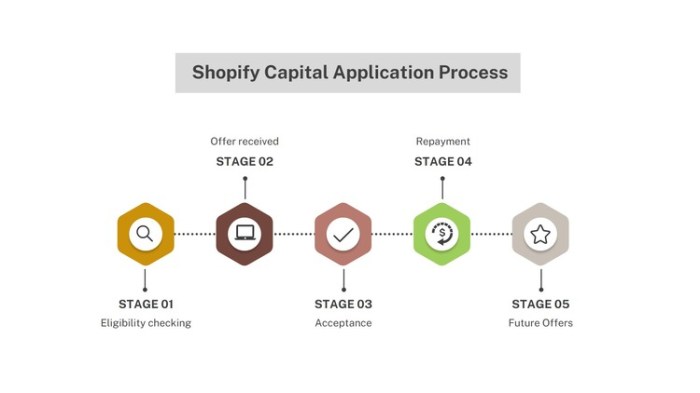

Application Process for Shopify Capital Loans

When looking to apply for a capital loan through Shopify, it's essential to understand the steps involved in the process, the documentation required, and the timeline for approval and disbursement of funds.

Step-by-Step Guide to Apply for a Shopify Capital Loan

- Create a Shopify account or log in to your existing account.

- Go to the Capital section in your Shopify dashboard.

- Click on the option to apply for a capital loan.

- Fill out the application form with accurate information about your business.

- Submit the application and wait for approval.

Documentation Required During the Loan Application Process

- Business information such as address, contact details, and industry.

- Financial statements including revenue, expenses, and profit margins.

- Personal identification documents for verification purposes.

- Business plan outlining your goals and how you plan to use the loan.

Timeline for Approval and Disbursement of Funds for a Shopify Capital Loan

- Approval times can vary but typically range from a few days to a couple of weeks.

- Once approved, funds are usually disbursed directly to your Shopify account.

- You can then access the funds and start using them to grow your ecommerce business.

Maximizing Ecommerce Growth with Shopify Capital Loans

When it comes to leveraging Shopify Capital Loans for your ecommerce business growth, strategic planning and execution are key. Here are some strategies to effectively utilize the loan amount to drive your business forward:

Optimizing Marketing Strategies

- Invest in targeted digital marketing campaigns to reach a wider audience and increase brand awareness.

- Allocate funds for social media advertising to engage with potential customers and drive traffic to your online store.

- Implement strategies to improve your website's visibility and organic search rankings.

Enhancing Product Offering and Inventory

- Expand your product range to cater to diverse customer needs and preferences.

- Invest in high-quality inventory to ensure product availability and timely fulfillment of orders.

- Introduce new and innovative products to stay ahead of competitors and attract more customers.

Improving Customer Experience

- Upgrade your website design and user interface to provide a seamless and engaging shopping experience.

- Offer personalized recommendations and discounts to enhance customer loyalty and retention.

- Invest in customer service training and tools to ensure prompt and effective resolution of queries and issues.

Success Stories

One successful ecommerce business that benefited from a Shopify Capital Loan is XYZ Company. They used the funds to revamp their website, launch a targeted email marketing campaign, and expand their product line. As a result, they experienced a 30% increase in sales within the first quarter.

Aligning Loan Amount with Growth Objectives

It is essential to align the loan amount with specific growth objectives to maximize the impact of Shopify Capital Loans. Whether it is to increase sales, expand market reach, or improve operational efficiency, defining clear goals will help you allocate resources effectively and measure success accurately.

Final Thoughts

In conclusion, choosing the right Shopify Capital Loan can be a pivotal decision in propelling your ecommerce business to new heights. By aligning your financial needs with the available options and leveraging the loan effectively, you can pave the way for sustainable growth and success.

FAQ Section

What are the key financial metrics to evaluate when deciding on a loan amount?

Some key financial metrics to consider include cash flow, revenue projections, and debt-to-equity ratio to ensure the loan amount aligns with your business's financial health.

How do short-term loans differ from long-term loans in terms of benefits and drawbacks?

Short-term loans typically have higher interest rates but provide quick access to funds, while long-term loans offer lower rates but may tie up capital for an extended period.

What documentation is required during the loan application process for a Shopify capital loan?

Common documentation includes business financial statements, tax returns, business plans, and information on collateral if required by the lender.

How can businesses effectively utilize the loan amount for ecommerce growth?

Businesses can invest in marketing, inventory expansion, technology upgrades, or hiring additional staff to enhance their online presence and customer reach.