Delving into Comparing Ecommerce Loans: Shopify vs. Stripe Capital, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

In the realm of online business financing, exploring the differences between Shopify and Stripe Capital loans can provide valuable insights for entrepreneurs looking to fund their e-commerce ventures effectively.

Introduction to Ecommerce Loans

Ecommerce loans are financial products specifically designed to meet the funding needs of online businesses. These loans provide online merchants with the necessary capital to invest in inventory, marketing, technology upgrades, or any other aspect of their ecommerce operations.Ecommerce loans play a crucial role in the growth and success of online businesses by providing them with access to the funds they need to expand their operations, reach more customers, and increase sales.

These loans can help ecommerce businesses seize growth opportunities, manage cash flow fluctuations, and navigate seasonal fluctuations in demand.

Examples of Ecommerce Loan Providers

- Shopify Capital: Shopify offers financing options to eligible merchants on its platform, providing them with quick and easy access to funds for inventory purchases, marketing campaigns, and other business needs.

- Stripe Capital: Stripe Capital offers loans to businesses that use its payment processing services, allowing them to access funds based on their transaction history and revenue streams.

- Kabbage: Kabbage provides lines of credit to small businesses, including ecommerce merchants, with a focus on quick approvals and convenient access to funds.

- Funding Circle: Funding Circle offers term loans to ecommerce businesses looking to expand their operations, invest in new technology, or hire additional staff.

Overview of Shopify Capital

Shopify Capital is a financing option offered by Shopify to help eligible merchants grow their businesses. It provides loans to qualifying Shopify store owners to invest in inventory, marketing, and other business needs.

Interest Rates on Shopify Capital Loans

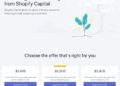

Shopify Capital offers fixed fees rather than traditional interest rates on their loans. The fixed fee is determined upfront, so merchants know exactly how much they will need to repay.

Eligibility Criteria for Shopify Capital Loans

- Merchants must have a Shopify store that is actively selling for at least 6 months.

- The store must meet a minimum revenue threshold, which can vary based on the loan amount requested.

- Merchants must have a good payment history and demonstrate consistent sales performance.

- Shopify reviews each merchant's account to determine eligibility and loan amount.

Overview of Stripe Capital

Stripe Capital is a financial service offered by Stripe, the popular online payment processing platform. This service provides loans to eligible businesses to help them grow and expand their e-commerce operations.

Services provided by Stripe Capital

- Quick access to funding: Stripe Capital offers fast approval and funding processes, allowing businesses to receive the funds they need in a timely manner.

- Flexible repayment options: Businesses can repay the loan through a percentage of their daily sales, making it easier to manage cash flow.

- No fixed repayment schedule: Unlike traditional loans, Stripe Capital loans do not have a fixed repayment schedule, providing more flexibility for businesses.

Application process for Stripe Capital loans

- Eligibility criteria: Businesses must meet specific requirements set by Stripe to qualify for a loan.

- Application submission: Businesses can apply for a loan directly through their Stripe account, simplifying the process.

- Approval process: Once the application is submitted, Stripe reviews the business's sales history and other data to determine loan eligibility.

Repayment terms of Stripe Capital loans

- Repayment percentage: Businesses repay the loan through a fixed percentage of their daily sales, which adjusts based on their revenue.

- No fixed term: Stripe Capital loans do not have a fixed repayment term, allowing businesses to pay off the loan as sales come in.

- No penalties for early repayment: Businesses can pay off the loan early without incurring any penalties, providing more flexibility.

Comparison of Shopify vs. Stripe Capital

When comparing Shopify Capital and Stripe Capital, it's important to consider the pros and cons of each loan service, as well as the customer reviews and satisfaction levels. Let's delve into the details to help you make an informed decision.

Pros and Cons of Choosing Shopify Capital over Stripe Capital

- Shopify Capital:

- Pros:

- Quick approval process

- Easy integration with Shopify platform

- No fixed monthly payments

- Cons:

- Higher interest rates compared to traditional loans

- Restricted to Shopify merchants

- Pros:

- Stripe Capital:

- Pros:

- Flexible repayment options

- Available to businesses using Stripe payment processing

- Cons:

- May require higher revenue thresholds for eligibility

- Less seamless integration for non-Stripe users

- Pros:

Customer Reviews and Satisfaction Levels

- Shopify Capital:

- Many Shopify merchants have praised the convenience and speed of Shopify Capital loans, citing them as a valuable resource for growing their businesses.

- Stripe Capital:

- Businesses using Stripe Capital have appreciated the flexibility in repayment options, but some have expressed concerns about the revenue thresholds required for eligibility.

Examples of Successful Businesses Using Shopify and Stripe Capital

Several successful businesses have utilized Shopify Capital and Stripe Capital to fuel their growth. For instance, XYZ Boutique used Shopify Capital to expand their product line and reach a wider audience, while ABC Tech leveraged Stripe Capital to invest in new technology and enhance their online services.

Final Summary

In conclusion, the comparison of Ecommerce Loans: Shopify vs. Stripe Capital sheds light on the nuances of each platform, offering a comprehensive view for businesses seeking financial support in the digital landscape.

Detailed FAQs

What are the key differences between Shopify and Stripe Capital loans?

While both platforms offer financing solutions for e-commerce businesses, Shopify Capital is tailored specifically for Shopify merchants, whereas Stripe Capital provides loans to businesses using the Stripe payment gateway.

How do the interest rates compare between Shopify and Stripe Capital loans?

Shopify Capital interest rates may vary based on the merchant's sales history and eligibility, while Stripe Capital offers fixed fee financing with no interest rates.

What is the application process like for Stripe Capital loans?

The application process for Stripe Capital loans is streamlined and integrated within the Stripe dashboard, making it convenient for businesses using the platform to access financing quickly.

Can businesses with a limited credit history qualify for Shopify Capital loans?

Shopify Capital considers various factors beyond credit history, such as sales performance and store consistency, making it possible for businesses with limited credit to qualify for funding.