Exploring the ins and outs of Shopify Capital Loan, this comprehensive guide offers valuable insights into the benefits, risks, and best practices associated with this financial option. Get ready to dive deep into the world of Shopify Capital Loans!

Introduction to Shopify Capital Loan

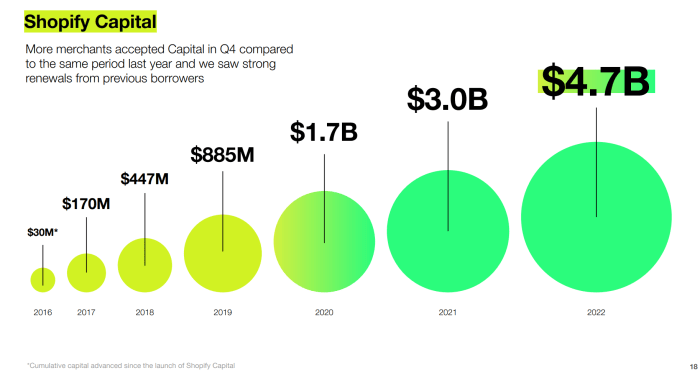

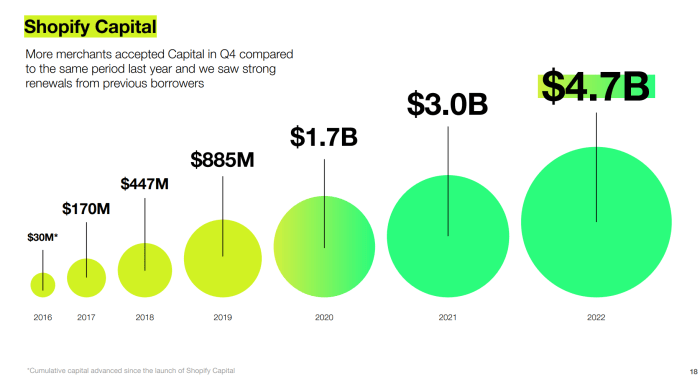

A Shopify Capital Loan is a financing option offered by Shopify to eligible businesses that use the Shopify platform for their online stores. This type of loan is designed to provide quick and easy access to funds for business owners looking to grow and expand their operations.

How Shopify Capital Loans Work

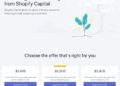

Shopify Capital Loans work by leveraging the data from a business's Shopify store to determine eligibility and offer a loan amount. The loan is repaid through a percentage of daily sales made through the Shopify platform, making it a flexible and convenient financing option for businesses.

The Purpose of a Shopify Capital Loan for Businesses

- Provides quick access to funds for business expansion

- Helps businesses manage cash flow during slow periods

- Allows for investment in inventory, marketing, or other growth opportunities

- Eliminates the need for traditional loan applications and lengthy approval processes

Pros of Shopify Capital Loan

Shopify Capital Loan offers several advantages to small businesses looking to grow and expand their operations. Let's explore some of the key benefits:

Access to Quick Funding

One of the major advantages of Shopify Capital Loan is the quick access to funding it provides. Small businesses can receive funds in a matter of days, which can be crucial for seizing growth opportunities or managing cash flow challenges.

No Fixed Monthly Payments

Unlike traditional loans, Shopify Capital Loan does not require fixed monthly payments. Instead, repayments are made based on a percentage of daily sales, making it easier for businesses to manage their cash flow.

No Personal Guarantee

Another benefit of Shopify Capital Loan is that it does not require a personal guarantee. This means that business owners are not personally liable for the loan, reducing the risk involved in borrowing funds.

Flexible Repayment Terms

Shopify Capital Loan offers flexible repayment terms that are tailored to the business's sales volume. This allows businesses to repay the loan at a pace that aligns with their revenue streams, making it easier to manage debt obligations.

Success Stories

Many small businesses have successfully utilized Shopify Capital Loan to fuel their growth. From launching new product lines to expanding into new markets, these businesses have leveraged the funding to achieve their business goals and drive success.

Cons of Shopify Capital Loan

When considering Shopify Capital Loans, it's essential to be aware of potential drawbacks and risks that come with this type of financing. While there are benefits to utilizing this option, there are also some limitations to consider.

Repayment Terms and Fees

- Shopify Capital Loans often come with shorter repayment terms compared to traditional bank loans. This can put pressure on your cash flow if you're unable to meet the accelerated payment schedule.

- Additionally, Shopify Capital Loans may have higher fees or interest rates than traditional bank loans, making them a more expensive financing option in the long run.

Limited Borrowing Amounts

- Shopify Capital Loans typically offer smaller borrowing amounts compared to what you might secure through a traditional bank loan. If you require a significant infusion of capital, this limitation could be a disadvantage.

Lack of Flexibility

- Unlike traditional bank loans that may offer more flexibility in terms of repayment schedules and terms, Shopify Capital Loans often have fixed terms that may not be as adaptable to your business's specific needs.

Best Practices for Using Shopify Capital Loan

When considering a Shopify Capital Loan, there are several best practices that can help you maximize its benefits and manage it effectively. Here are some tips to make the most out of a Shopify Capital Loan:

1. Plan Your Usage Carefully

- Identify specific areas of your business that require investment or improvement.

- Create a detailed plan on how you will use the funds to achieve your business goals.

- Avoid using the loan for non-essential expenses to ensure maximum return on investment.

2. Monitor Your Cash Flow

- Regularly track your sales, expenses, and revenue to ensure you can comfortably repay the loan.

- Adjust your budget and cash flow projections accordingly to accommodate loan repayments.

- Be proactive in managing your finances to avoid any cash flow issues.

3. Invest in Growth Opportunities

- Use the loan to invest in growth opportunities such as expanding your product line or launching a marketing campaign.

- Focus on initiatives that will generate a positive return on investment and contribute to the long-term success of your business.

- Strategically allocate funds to areas that will drive business growth and increase profitability.

4. Evaluate Your Business’s Financial Health

- Assess your business's financial health before taking out a Shopify Capital Loan.

- Review your revenue, expenses, and overall financial performance to determine if you can afford the loan.

- Consider consulting with a financial advisor to ensure the loan aligns with your business's financial goals.

Conclusive Thoughts

In conclusion, Shopify Capital Loan presents a unique opportunity for businesses to access much-needed funds, but it's crucial to weigh the pros and cons carefully. By following best practices, businesses can maximize the benefits of Shopify Capital Loans and propel their growth to new heights.

FAQs

What are the eligibility criteria for Shopify Capital Loan?

To qualify for a Shopify Capital Loan, businesses must meet certain revenue thresholds and have a track record of consistent sales on the Shopify platform.

How quickly can you receive funds from a Shopify Capital Loan?

Typically, funds from a Shopify Capital Loan are disbursed within a few business days once the application is approved.